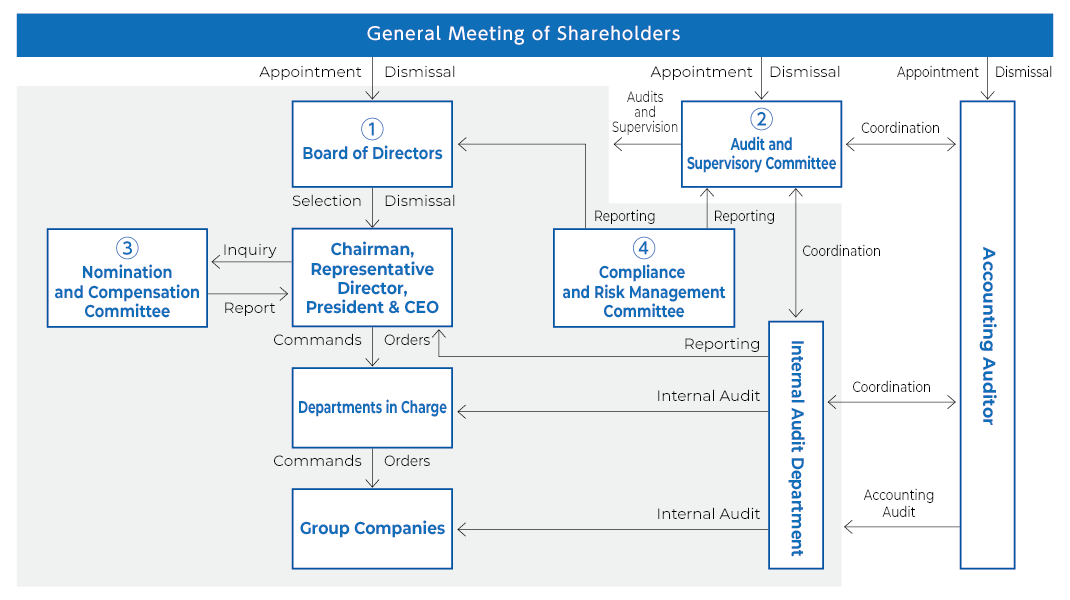

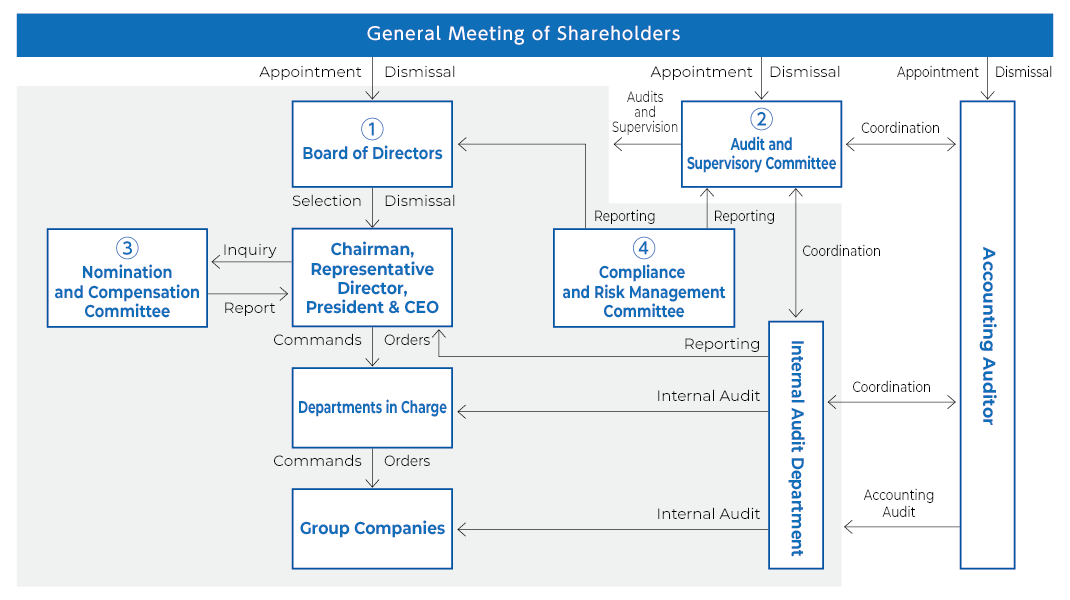

Corporate Governance System

In addition to adopting a Company with an Audit and Supervisory Committee governance structure, Hoshizaki has set the ratio of outside directors on its Board of Directors to at least one third.

The Board of Directors meets regularly every month as a body for conducting management-related decision-making, formulating policies and management strategies for the entire group, and supervising business execution. The Board consists of eight directors who are not Audit and Audit and Supervisory Committee Members (including two outside directors) and three directors who are Audit and Supervisory Committee Members (including two outside directors).

In addition, one full-time Audit and Supervisory Committee Member is selected by resolution of the Audit and Supervisory Committee.

Two outside directors with management experience at listed companies are appointed as non-Audit and Supervisory Committee outside directors. One attorney and one certified public accountant are appointed as Audit and Supervisory Committee outside directors.

Hoshizaki has further enhanced corporate governance by strengthening the supervisory function of its Board of Directors through the use of the executive officer system introduced in July 2019, through a progressive separation of management and supervision from business execution.

The Audit and Supervisory Committee holds active exchanges of views between directors with sufficient internal knowledge of the Company and outside directors with extensive external experience and knowledge. It fairly audits and monitors the execution of duties by directors (excluding directors who are Audit and Supervisory Committee Members).

Hoshizaki has also established a “Compliance and Risk Management Committee”. This committee is composed of directors and related personnel. Its aims are to promote risk management within the group, share information, promptly respond to risks, and determine measures to avoid or mitigate the manifestation of risks, etc.

On January 20, 2022, the Company established a voluntary Nomination and Compensation Committee for the purpose of strengthening the fairness, transparency, and objectivity of procedures related to the nomination and compensation of directors and executive officers, and to further enhance the corporate governance system.

The Nomination and Compensation Committee is chaired by an independent outside director and consists of the President, Chairman and all independent outside directors, with a majority of its members being independent outside directors.

Reasons for selecting the corporate governance structure

Hoshizaki has adopted the governance structure of a Company with an Audit and Supervisory Committee in the belief that granting voting rights at the meetings of the Board of Directors to several highly independent outside Directors who are Audit and Supervisory Committee members will strengthen the supervisory function over the Board of Directors and enhance its corporate governance further.

Members of each organization

(Note) ○ indicates membership.

Corporate governance structure

Status of outside directors

As a business practitioner, Hoshizaki appoints as directors individuals who have abundant experience and a high level of insight in general management (excluding directors who are Audit and Audit and Supervisory Committee Members). For outside directors who are Audit and Audit and Supervisory Committee Members, Hoshizaki appoints individuals who can monitor management from an objective and neutral standpoint by utilizing their perspectives based on high expertise and a wealth of experience and knowledge in auditing and other activities, either as an attorney or certified public accountant.

All four outside directors are independent of the management team that executes business, and they have been registered with the Tokyo Stock Exchange and the Nagoya Stock Exchange as independent officers to ensure there are no risks of conflicts of interest arising with the general shareholders.

When appointing outside directors, Hoshizaki uses the independence criteria established by the Tokyo Stock Exchange as the Company’s criteria for determining independence, and appoints as outside directors individuals who will contribute to enhancing the supervisory function of the Board of Directors and stimulating discussion.

The two outside directors who are members of the Audit and Supervisory Committee exchange information and coordinate with the full-time Audit and Supervisory Committee Members and the internal control divisions through meetings of the Board of Directors, the Audit and Supervisory Committee, and the Compliance and Risk Management Committee. They also enhance mutual collaboration through regular meetings with the Audit and Supervisory Committee, the Internal Audit Department and the Accounting Auditor.

Assessing Board Effectiveness

Hoshizaki conducts annual evaluations of the effectiveness of the Board of Directors as a whole, and implements measures to improve its effectiveness based on the results of these evaluations.

To evaluate the overall effectiveness of the Board of Directors for FY2023, we conducted a questionnaire to all 11 Directors (4 of them are Independent Outside Directors) including Directors who are Audit and Supervisory Committee members.

The questionnaire covered the following six categories:

(1) Effectiveness of discussion and examination of the Board of Directors, (2) Effectiveness of the supervisory function of the Board of Directors, (3) Whether the Board of Directors serves as a sound place for discussing sustainable growth of the Company, (4) Effectiveness of the environmental improvement status of the Board of Directors, (5) Effectiveness of responses to shareholders and stakeholders, and (6) Effectiveness regarding the composition of the Board of Directors.

As a result of deliberation by the Board of Directors based on the results of the above, it was determined that the overall effectiveness of the Board of Directors in FY2023 had been ensured. We will address the issues identified through this effectiveness evaluation for future improvement.

Audits

Audits carried out by the Audit and Supervisory Committee

a. Hosting meetings, etc. at the Audit and Supervisory Committee

As a general rule, the Audit and Supervisory Committee meets once a month and whenever needed.

In the current business year, it met 14 times and deliberated 15 items for resolution and 73 items for reporting, etc.

|

15 items for resolution

|

-

- Determining the audit policy and basic plan for the 78th fiscal year

-

- Consenting to a proposal for the election of directors as Audit and Supervisory Committee Members

-

- Selecting a Chairman, full-time Audit and Supervisory Committee Members, and selected Audit and Supervisory Committee Members

-

- Reappointing the Accounting Auditor, and consenting to the Accounting Auditor’s compensation

-

- Consenting to performance-based evaluations of Audit and Supervisory Committee assistants

-

- Judging the effectiveness of the basic policy for establishing an internal control system

-

- Exercising the right to express opinions on the appointment and compensation of directors who are not Audit and Supervisory Committee Members

-

- Determining the audit report of the Audit and Supervisory Committee, etc.

|

| 73 items reported, etc. |

-

- Reporting on the results of audits of important documents (monthly)

-

- Reporting on the results of on-site audits by full-time Audit and Supervisory Committee Members (case-by-case basis)

-

- Reporting on audit progress reports by the Internal Audit Department (quarterly)

-

- Sharing of quarterly review reports (quarterly)

-

- Exchanging views on key audit matters (KAMs)

-

- Results of pre-approval deliberations in accordance with the Code of Ethics of the International Ethics Standards Board for Accountants (IESBA)

-

- Status reports on physical inventories

-

- Reporting on the results of audits by the Accounting Auditor, etc.

|

In addition, in order to strengthen cooperation with auditors at group companies in Japan and provide them with training opportunities, a liaison meeting attended by auditors at group companies in Japan is held twice a year in principle. In the current business year, meetings were held in May and October.

b. Specific activities of the Audit and Supervisory Committee and its Members

Audit and Supervisory Committee Members attend meetings of the Board of Directors and the Compliance and Risk Management Committee to monitor and supervise the execution of duties by directors and to monitor the status of compliance and risk management throughout the Group.

In addition, full-time Audit and Supervisory Committee Members attend the Corporate Management Committee Meeting and other important meetings and share the information obtained with the two part-time outside directors who are Audit and Supervisory Committee Members in order to eliminate information gaps among Audit and Supervisory Committee Members and to improve the effectiveness of its auditing and other activities.

The two outside directors who are Audit and Supervisory Committee Members attend the Nomination and Compensation Committee as members, monitoring and supervising the appropriateness of nominations and compensation for directors and executive officers.

The Audit and Supervisory Committee’s major audit themes in the current business year included the adequacy of compliance and risk management, the effectiveness of the whistle-blowing system, the status of sustainability management, and the monitoring of non-financial information disclosures.

A summary of its activities and their results are given as follows.

| Major audit themes |

Outline of activities, etc. |

|

Adequacy of compliance and risk management

|

Attended monthly meetings of the Compliance and Risk Management Committee to receive explanations of Group compliance and risk incidents and their current status, asked questions and made suggestions as necessary.

As a result, it was determined that the Group’s internal control system, including compliance and risk management, is sufficient.

|

|

Effectiveness of the whistleblower system

|

Received reports on all whistleblowing cases submitted to the whistleblower hotline, as well as reports on the status of subsequent actions, asked questions and highlighted issues as necessary.

As a result, it was determined that the Hoshizaki’s whistle-blowing system is being effectively operated and that there have been no particular problems in the handling of the reported cases.

|

|

Status of sustainability management

|

Hoshizaki has set KPIs to quadruple by FY2025 the number of women in leadership positions (equivalent to section manager and above) compared to FY2020 (50), and to increase by 1.5 times by FY2025 the number of women in managerial positions (equivalent to assistant manager and above) compared to FY2020 (300). Efforts and progress towards these targets were monitored, and it was confirmed that steady progress is being made.

It was confirmed that the Sustainability Committee established in June 2022 meets quarterly, and that the Board of Directors oversees the status of sustainability management initiatives through reports on activities from this committee.

|

|

Status of non-financial information disclosures

|

In the current business year, the Company aimed to disclose KPIs for all six materialities in the Integrated Report, and it has been monitoring progress.

As a result, it was confirmed that the Company achieved enhanced non-financial information disclosure in the Integrated Report issued in July 2023, including KPI disclosure for all materialities.

|

c. Attendance of individual Audit and Supervisory Committee Members at major meetings

Status of internal audits

Hoshizaki has established an Internal Audit Department as an organization that audits the entire Group.

It consists of eight full-time employees, including one general manager, under the direct control of the President and Representative Director.

The Internal Audit Department conducts audits of the Company and its group companies in accordance with the Rules on Internal Audits and the Basic Plan for Internal Audits, focusing on the appropriateness of business execution and the effectiveness of internal controls over financial reporting.

To ensure and improve the effectiveness of internal audits, Hoshizaki has established and operates multiple reporting lines from the general manager of the Internal Audit Department.

Firstly, internal audit plans, the status of implementation, and results are reported to the President and Representative Director as necessary, and quarterly reports are reported to the Audit and Supervisory Committee.

In principle, a full-time Audit and Supervisory Committee Member is present, enabling dual reporting to the President and Representative Director as necessary.

The Board of Directors is also informed of the contents of internal control reports.

Hoshizaki exchanges opinions with the Accounting Auditor as appropriate, in addition to collaborating on three-way audits.

Officers’ compensation

Policy to Determine the Amount of Compensation, etc., for Officers, and the Methods for Calculation

Hoshizaki determines the compensation of directors (excluding outside directors and directors who are Audit and Supervisory Committee Members) after consulting and reporting to the voluntary Nomination and Compensation Committee, which is chaired by an independent outside director.

Details of the policy for determining the details of compensation, etc. for each individual director are described as follows (a through e).

a. Policy on basic compensation

Hoshizaki’s basic compensation (fixed compensation) is a monthly cash compensation in a fixed amount, commensurate with the individual’s position and recognizing the qualities and abilities required to fulfill the responsibilities of an officer.

b. Policy on performance-linked compensation, etc.

Hoshizaki’s variable (performance-linked) compensation is oriented toward company-wide optimization and is intended to encourage the achievement of performance targets and sustainable enhancement of corporate value.

Performance indicators consistent with the medium-term management targets are set as follows: (1) consolidated operating profit for the previous fiscal year; (2) financial and non-financial targets according to the scope of responsibility of directors; and (3) other qualitative assessments. Monetary compensation is paid in variable amounts according to the degree of achievement of these targets.

Hoshizaki has adopted a scheme of “fixation of variable compensation”, (a scheme in which the annual salary is varied in response to the performance of the previous fiscal year and is paid in 12 installments). Compensation is paid monthly as cash compensation based on the degree of achievement of the above items (1) through (3).

c. Policy on non-monetary compensation, etc.

For non-monetary compensation at Hoshizaki, transfer-restricted stock compensation is determined based on the director’s position and role at the Company, with the aim of providing incentives to sustainably increase corporate value and share shareholder value. This compensation is paid at a fixed time each year.

For non-resident directors, alternative compensation linked to the Company’s stock price, etc. is paid in cash.

d. Policy on ratio of compensation, etc.

Compensation for each director at Hoshizaki (excluding outside directors and directors who are Audit and Supervisory Committee Members) consists of “basic compensation (fixed compensation)”, “variable compensation (performance-linked compensation)”, and “transfer-restricted stock compensation” (non-monetary compensation).

The ratio for the President and Representative Director is generally 6:2:2, and the ratio for other directors (excluding outside directors and directors who are Audit and Supervisory Committee Members) is generally 7:2:1.

Compensation for outside directors and directors who are Audit and Supervisory Committee Members is limited to basic compensation only.

e. Policy on delegation of decisions regarding compensation, etc.

In order to increase fairness, transparency, and objectivity, and to enhance corporate governance, individual compensation is determined by the President and Representative Director in accordance with the Company’s regulations after deliberation by the voluntary Nomination and Compensation Committee, the chair of which is an outside director and two-thirds of whose membership is composed of outside directors.

Total compensation, etc. for each officer category, total compensation etc. by compensation type, and number of officers eligible to receive compensation, etc.

(2023 results)

Dialogue with shareholders

Hoshizaki recognizes that in order to achieve sustainable growth and increase its corporate value over the long term, it is important to engage in active dialogue with its shareholders and investors, reflect their opinions and requests in the management, and use this to realize growth in the Company.

Basic IR policy and method of information disclosure

Hoshizaki conducts IR activities in order to provide shareholders and investors with the fair and timely information needed to make investment decisions.

The information published by the Hoshizaki Group is disclosed via its registration with TDnet and by posting information on the Hoshizaki Group IR website.

In addition to striving to ensure the fairness of information, even when information does not fall under the scope of the Timely Disclosure Rules, Hoshizaki Group discloses such information in accordance with the aims of these rules.

Furthermore, in light of the increase in the ratio of foreign shareholders, since the second quarter of the fiscal year ended December 31, 2019, Hoshizaki has disclosed its business results, financial meeting materials (summarized version), and convocation notices in English and opened an English-language version of its website.

Communication with shareholders and investors

Hoshizaki holds quarterly financial meetings to explain its business results (actual and forecasts) and management strategies to institutional investors, at which the President and Representative Director give explanations in person.

Individual meetings are also held by management and IR representatives, and Hoshizaki also attends various briefings hosted by securities firms.